USA![]()

The EU is looking at retaliating against the US on an ongoing dispute about Boeing at the WTO. The public consultation will last until May 31, 2019 at which point it seems the EU commission will make a decision on imposing or not tariffs on a list of US products including raw and roasted peanuts. This could obviously have a dramatic effect on exports of US peanuts into the EU. Fyi, the US exported a total of 145’852 mt during the period of March 2018 and February 2019. If the EU were to impose a tariff on US peanuts, one cannot expect the exports to fall to zero, but it goes without saying that exports to the EU would fall. It would give obviously an opportunity to our largest competitor (Argentina and Brazil) to increase their price (hence their margins). I shall keep you posted on the Trump/EU saga.

As to the new crop, plantings are under way. The hopes that cotton moves higher have faded, at least for the moment, with price having gone to 77 and now back to below 75 for December 19. There is still lot of hopes that once the US/China trade issues gets solved, cotton will move higher. If it was to move higher for next year, we could potentially see a sharp decline in peanut plantings for the 2020 crop in view of the current peanut oversupply. Lots of if and hopes, but something to watch nevertheless as this could impact the second half of 2020.

Peanut plantings should end up being fairly similar to the 2018 crop, potentially slightly higher. This gives the US a potential to produce a 2.8 million fst crop with normal yields. That gives us an estimated carryover of 1.25 million fst for August 1, 2020 after an estimated 1.32 million fst for August this year. Those numbers are due to change with the disposition of the 2017 crop forfeitures, export and domestic demand. But overall enough peanuts for the market to continue being oversupplied.

Things to think about that could make this change: obviously a drought impacting the supply; potential increase in buying from Chinese buyers due to tighter Chinese domestic supply; lower EU exports as mentioned above.

The current crop market remains extremely quiet with prices in the mid 40’s for negative material. Nothing has changed, quality is going at a premium. Depending on the quality, prices are anywhere between 47 and 55 cents. The only activity has been on red tag material going to China.

The new crop market remains as well very quiet with buyers at 45 cents and sellers at 47 cents and above. The lack of selling is mostly attributed to the lack of contracting which is somewhat surprising in an environment of poor famer financial situation. One would think that with plantings taking place and/or fast approaching, many famers would need to contract to get loans. Something I am still trying to figure out. But if farmers were able to plant and not contract, things to get interesting. Not only would they be able to ride the weather market of the summer, but they would be able to ride the cotton market which could potentially impact the market since the farmers have 9 months to decide what to do once they get their loan.

USDA stocks and processing for March 2019: we the exception of peanut snacks, demand has had a fantastic month with candy, butter and inshells showing great increases. It looks as if the price decrease the butter manufacturers took had tremendous effect on consumption. Lets hope for those numbers to continue in this direction.

Mar 19 vs. Mar 18: Peanut candy up 14.64%, Peanut Snacks down 14.31%, Peanut butter up 23.53%, Total edible up 12.29%, Inshells up 8.84%

Aug 18-Mar 19 vs. Aug 17-Mar 18: Peanut candy down 5.05%, Peanut Snacks down 8.97%, Peanut butter up 1.15%, Total edible down 1.23%, Inshells down 2.26%

USDA exports for March 2019 will be announced May 9, 2019.

Argentina![]()

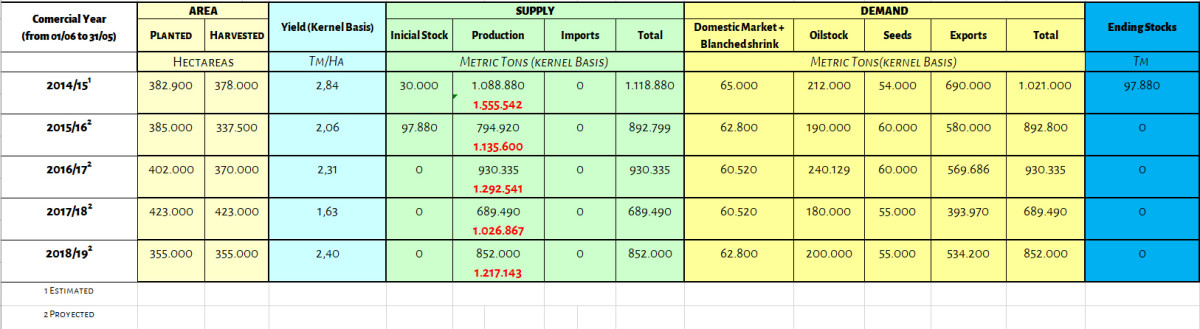

First crop estimate from March 31, 2019 from the Argentine Peanut Chamber:

The new crop in Argentina is developing well with adequate weather so far. Very little has been harvested so far with probably 35/40% dug. Lets hope for this good weather to continue until the end of harvesting.

Prospects are looking good with the Chamber of commerce estimating an availability of 534’000 mt for exports. The market will most definitely need it with Brazil suffering somewhat from a lower crop and lower quality, and the US not having much more supply of current crop for the EU (above what has been sold).

Despite the fact that Argentina has the market in its hands (at least for the time being), price have dropped more to levels of us$ 1425/1450.- Cfr for blanched wholes.

Brazil![]()

The harvesting of the Brazilian new crop is basically completed and the shellers are still not sellers. That brings the question as to why. By all accounts, it seems that losses prior to harvesting were already calculated at about 20%. But one has to wonder if the heavy rains that affected the crop at some point during harvesting did not result in heavier losses. On the other hand, I believe that the Brazilian are heavily sold and some probably close to sold out. Part of the answer for them not selling might also be attributed to the fact that farmers are wanting more money for any uncontracted farmerstock. One has also to look at what is happening internally in Brazil. One of our source reports that reforms that are taking place (such as welfare reforms), if successful, could trigger a strengthening of the Real which would make life even more difficult.

Thereafter remains the question on what will happen with Brumau and its sales. By all accounts, it seems that they are unable to buy any farmerstock which, if the situation remains the same, means that they will be unable to fulfill their contracts. This could create some problems for some. There is also a question as to who will be able to buy their farmerstock; probably will be spread out between the different players.

China![]()

New crop plantings are underway. From all the reports I receive, plantings estimates vary from 5% down to 5% up. With the recent increase in prices, I would estimate the 5% up scenario to be the most likely.

The past month and a half has since a jump in the Chinese domestic price. The reason for this increase in price of roughly 20% is due it seems to a lack of supply which doesn’t make any sense considering the fact that China had seemingly a 3 million tons carryover and 16 million tons from the 2018 crop. If tightness is the real issue, then the carryover and/or the 2018 crop were not as high as predicted. This is not only important for the current market for next market as well. If supply is tight and plantings for the 2019 crop are only up 5%, supply should remain an issue. If supply remain an issue, then this will give many origins certain opportunities. Argentina and Brazil for oil, peanuts from different origins such Africa (mainly Senegal), India and the regular origins including the US.

The US has seen a renewed buying interest from China where many sales of higher aflatoxin material have taken places. This I believe will continue for the next month. The Chinese buyers have also shown much interest in the US 2017 crop forfeited peanuts. Unfortunately at this time, the US government has only tried to sell about 47’000 fst in a barter trade for peanut butter. We will only know by May 6 how successful they were. Thereafter it is unknown what the US government will do with the remainder of the forfeited peanuts, but needless to say that China is by far the best option as the only other option will be for crush for the US market in a market that has enough oilstock material.

India![]()

Indian prices have moved up substantially lately seemingly due to the buying interest from China.

South Africa![]()

Latest CEC crop estimate (3rd forecast) calls for 20’050 has for a crop of 22’705 tons, a 12.96% increase vs. the 2nd forecast, but a 39.83% decrease vs. last year production.

No doubt that South African buyers will have to buy large quantities from foreign origins, probably mostly from Argentina. Some buying has already taken place, but with the new crop coming in and the Rand fairly stable (now at 14.37 s us$), further buying seems to be delayed. Some are hoping for the Rand to strengthen after the new election.

– By : Mr Alex Izmirlian